Virtual CFO

IN A NUTSHELL:

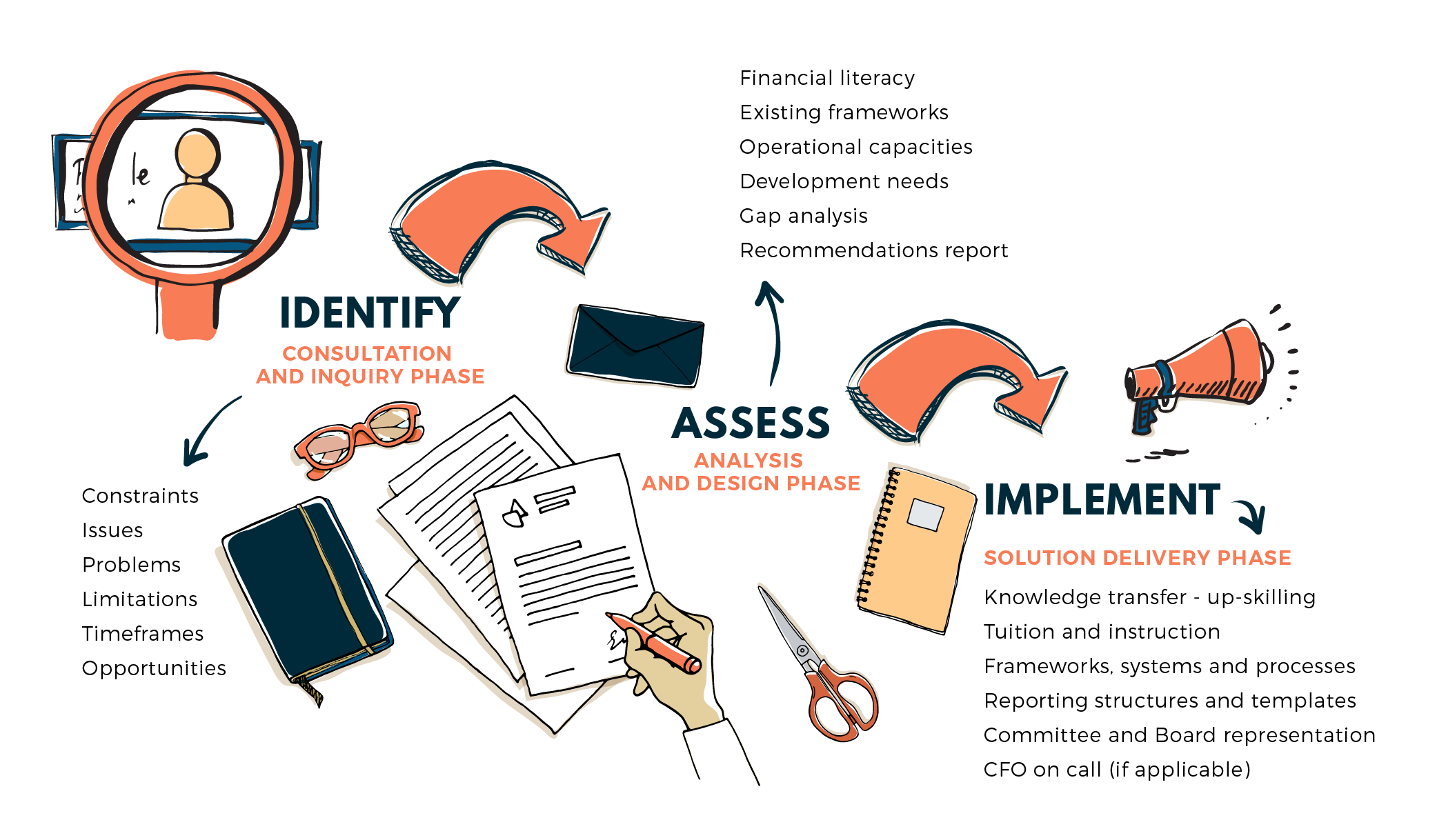

For businesses that require the support of a finance expert, Figure Eight’s virtual CFO service could be just the answer.

Should you be a growing business that can’t yet afford the luxury of a full-time CFO, perhaps you need to focus on doing what you do best rather than spend your time managing the finances or more simply feel the need for an occasional financial health check, Figure Eight can help.

This involves Figure Eight founder David Thomas working with your business on an as need’s basis. The benefit is that you pay for only what you need tailored to your requirements. This may be once per week, once per month or quarter dependent on your business needs.

With over thirty years’ experience together with a proven track record of business turnaround both as a CFO and CEO David intimately understands the requirements for optimum financial management performance. Figure Eight delivers more than a ‘just a CFO’. Figure Eight’s proven experience in business turnaround ensures you receive the service of an all-round business advisor. It’s the service and advice of a proven performer who has been there in the commercial trenches and understands the commercial intricacies of running a business.

This combination of experience and achievement provides the key for SME’s requiring an affordable solution for their financial and business management challenges.

David’s thirty plus years of experience with a proven track record of business turnaround provides the key for SME’s requiring an affordable solution for their financial and business management challenges.

In essence, Figure Eight aims to deliver the service and guidance you always expected from your accountant but never actually receive.

Should you require something ongoing and regular or just a one-off or occasional financial health check Figure Eight can help.

We help with things like…

- Commercial guidance

- Business strategy

- Performance management reporting (the right KPI’s for your business)

- Profitability and breakeven analysis

- Cash flow optimization

- Cash ‘burn’ analysis and scenario modelling

- Budgets & forecasting

- Pricing analysis

- Business plans

- Business and project evaluation

- Processes and policy

- Systems set up & enhancements

- Risk and compliance